Philippine Offshore Gaming Operators (POGOs) that fail to settle their unpaid taxes are not allowed to resume their operations amid the coronavirus disease 2019 (Covid-19) pandemic, Malacañang said on Thursday.

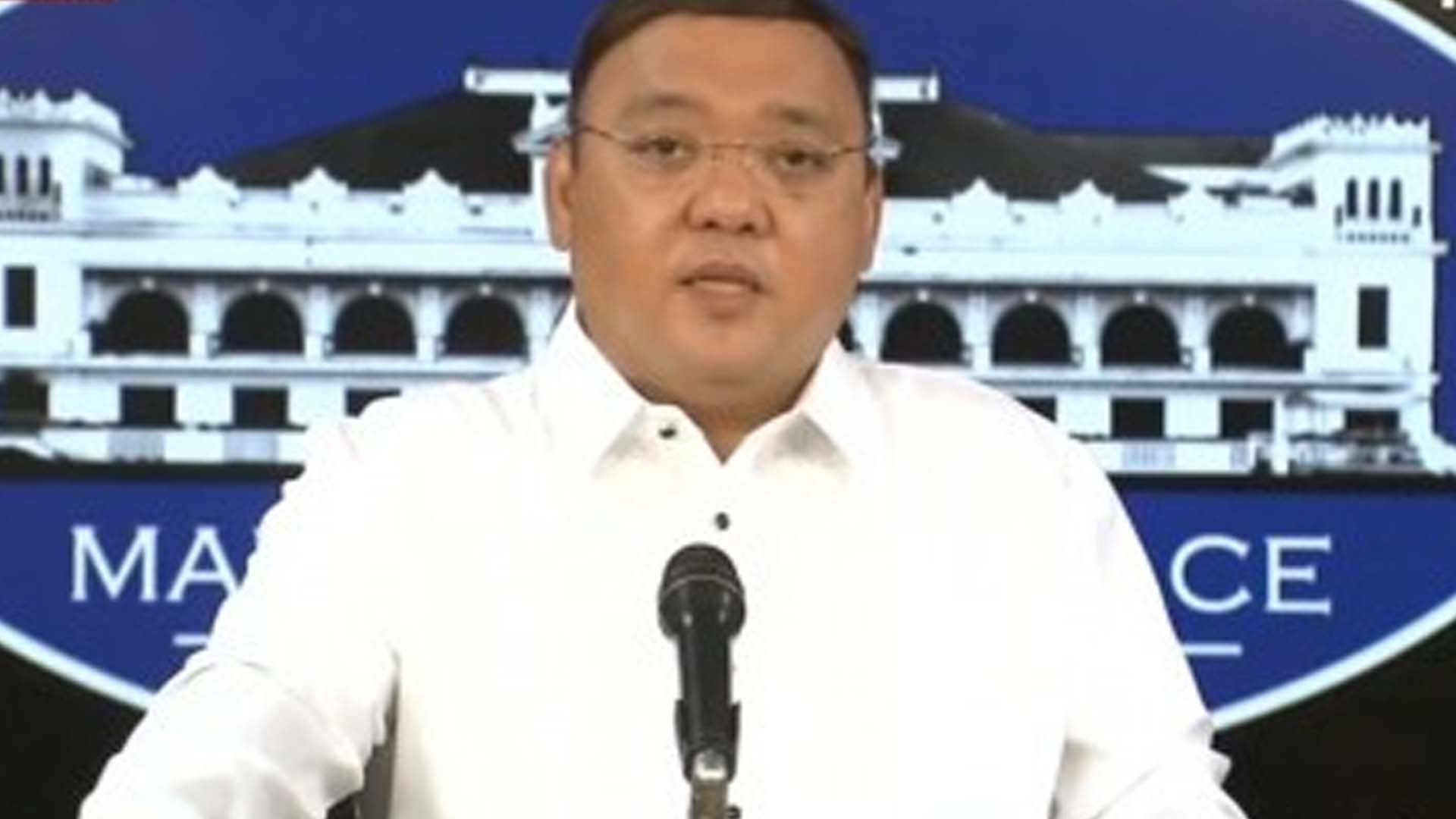

In a virtual presser aired on state-run PTV-4, Presidential Spokesperson Harry Roque ensured that the government would not tolerate tax-evading POGOs.

“Hindi po tayo papayag na mag-operate ang mga POGO ng may pagkakautang (We would not allow POGOs with unpaid taxes to operate),” Roque said.

On Wednesday, Finance Secretary Carlos Dominguez III said his office is now looking into reports that some POGOs have reopened despite their failure to pay the tax payments required by the government.

The Finance department’s probe began following Senator Joel Villanueva’s recent revelation that only two POGOs were able to settle their tax liabilities, but many more already resumed their operations.

It was in March when the Philippine Gaming and Amusement Corp. (PAGCOR) suspended POGO operations due to the threat posed by Covid-19.

However, the government allowed in May the partial reopening of offshore gaming firms on conditions that they first settle taxes and obtain clearance from the Bureau of Internal Revenue, pay fees required by PAGCOR, and shoulder the Covid-19 testing of its employees.

Only 30 percent of the POGO workforce is allowed to report for work.

Dominguez said his department is already monitoring the tax-evading POGOs that are reportedly operating amid the nationwide implementation of community quarantine.

To date, there are 60 licensed POGO operators in the Philippines.

From 2016 to 2019, the revenues collected by PAGCOR from POGOs already reached over PHP18 billion.

Last year, the government collected PHP6.4 billion after it ran after tax-deficient POGOs.

Dominguez’s office has also estimated that the government would be able to collect up to PHP20 billion a year in corporate and personal income taxes from POGOs. (PNA)